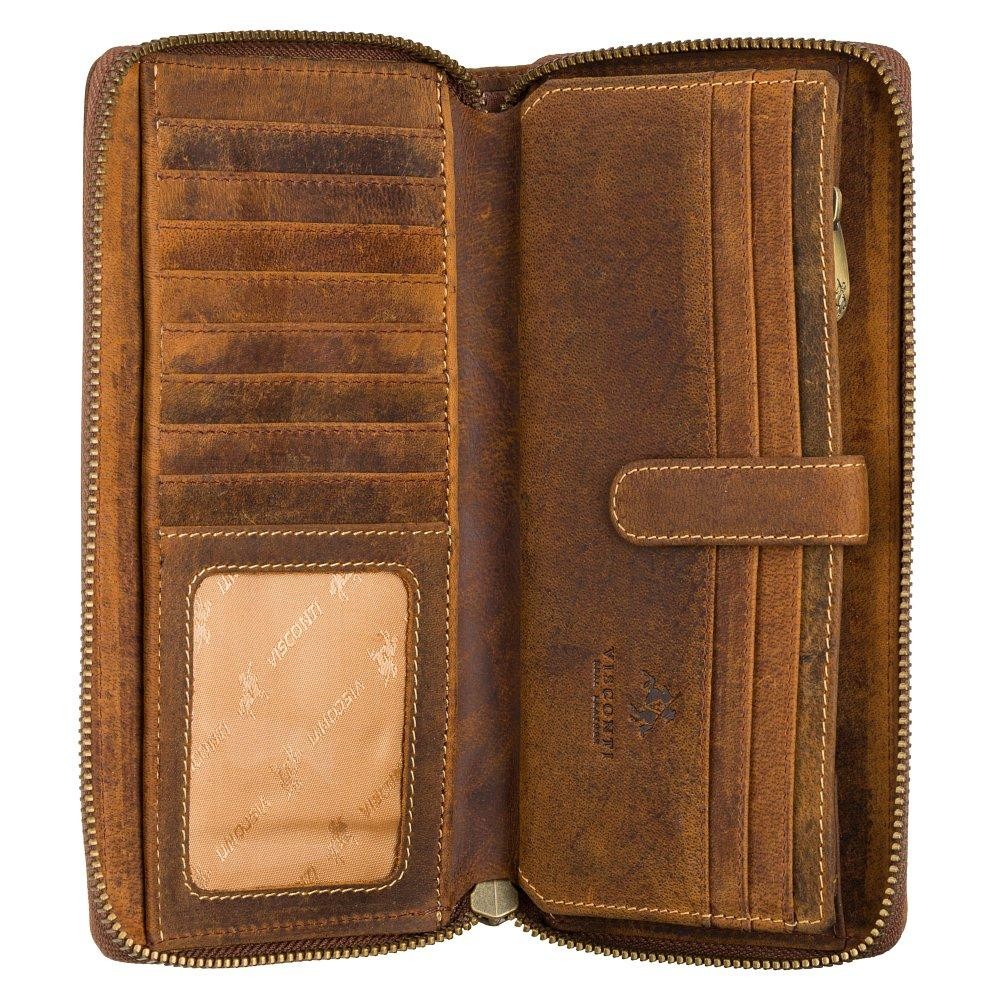

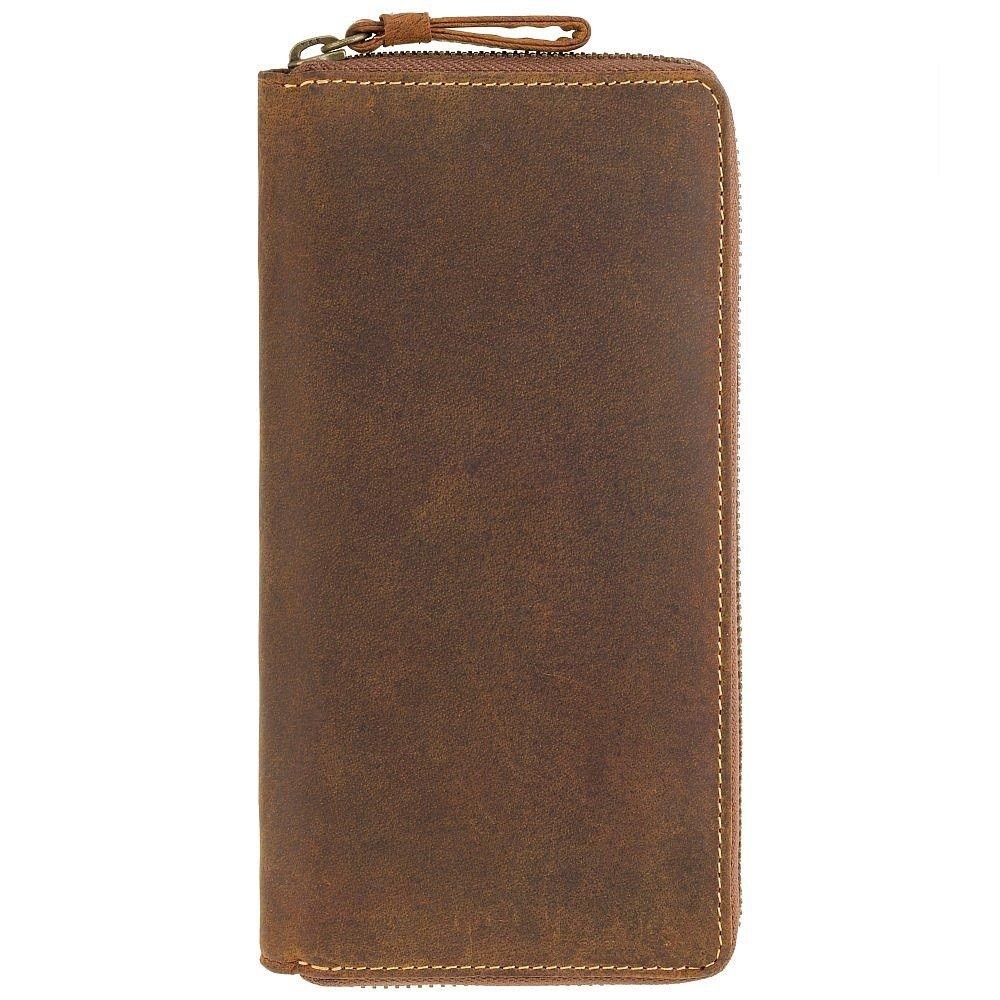

Mercucio - Velkoobchod kožené galanterie - Dámské peněženky - Dámská peněženka RFID MERCUCIO koňak 2111654

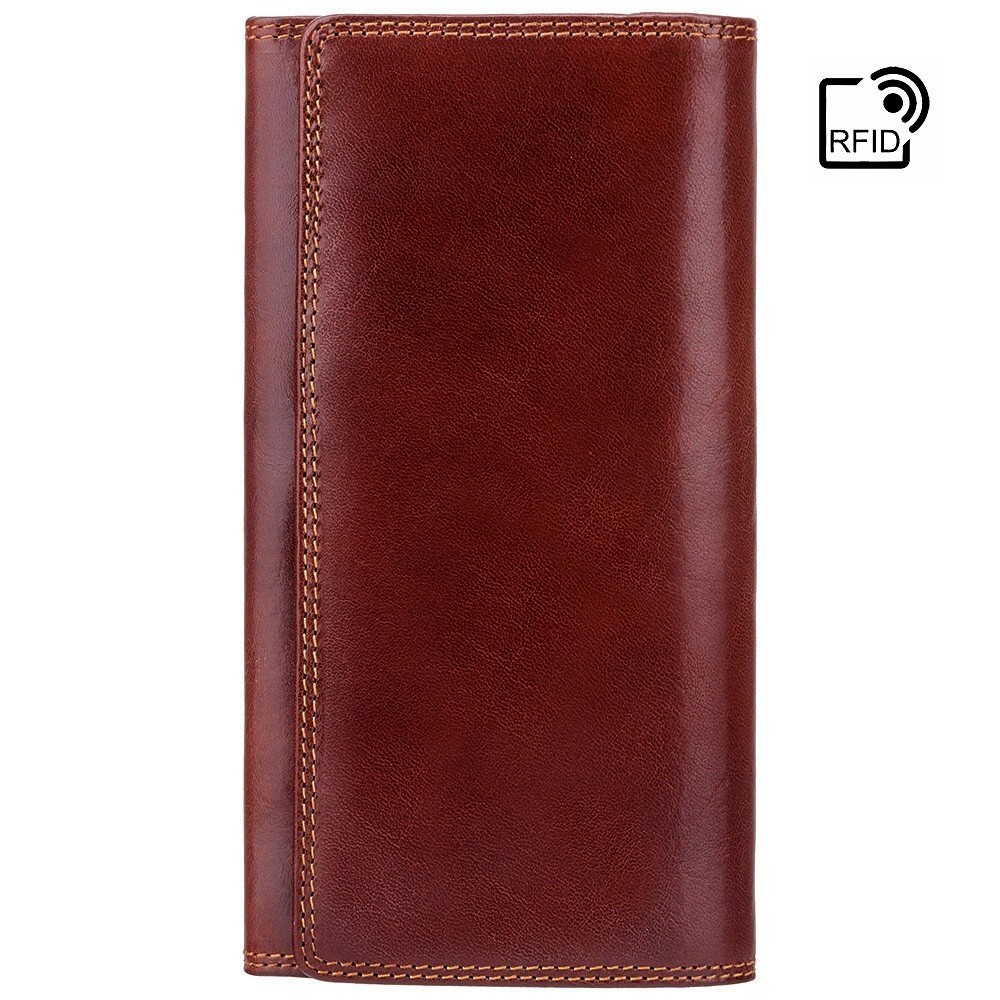

Gregorio luxusní velká šedá dámská kožená peněženka v dárkové krabičce | Dámské peněženky | Mikaton.cz

Mercucio - Velkoobchod kožené galanterie - Dámské peněženky - Dámská peněženka RFID MERCUCIO koňak 2111654